Inflation and Interest with the price trend of mutual funds and real estate trusts

Previously, in the beginning of 2020, the US Federal Reserve (FED) used an accommodative monetary policy by reducing the policy interest rate (FED Funds Rate) to a level of 0.00 - 0.25% to manage during the period when the economy was affected by COVID-19 outbreak and later the COVID-19 situation eased, causing the US economy to recover. But it also causes high inflation. In 2022, the average inflation rate was as high as 8%, causing the FED to adjust interest rates 11 times continuously, starting in the beginning of 2022, until the interest rate was at 5.25 - 5.50% in June 2023, which the US economy at Reducing the heat causes inflation to decrease. In September 2023, it dropped to 3.7%. However, the FED is likely to maintain the policy interest rate at a high level (Higher for Longer) to keep inflation below 3%.

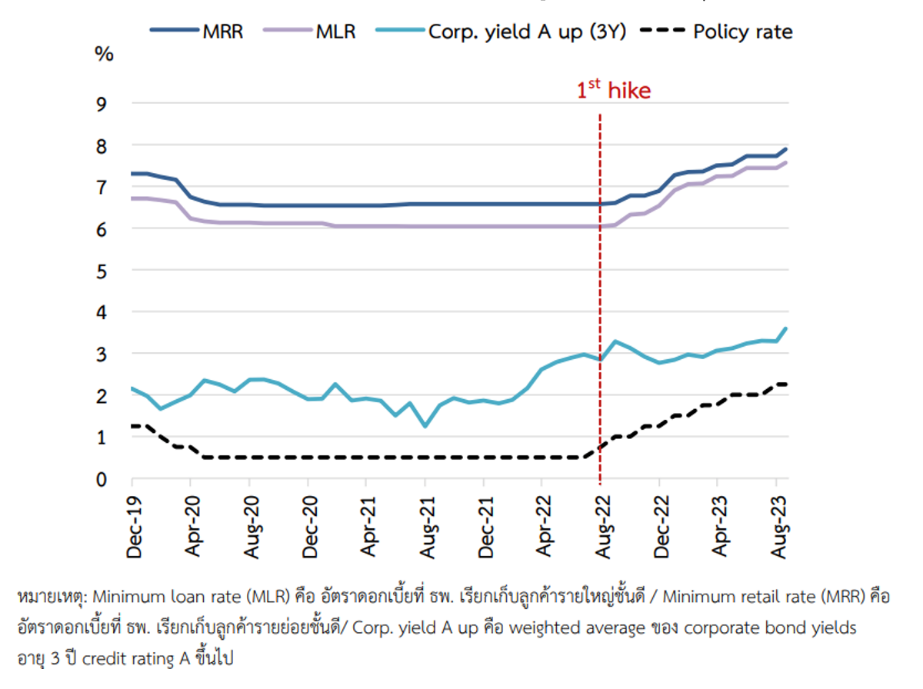

This is a result of the FED's policy interest rate increase to put pressure on inflation. causing capital to flow out of various countries with low interest rates and affect the depreciation of the currency against the US dollar. including Thai baht The Bank of Thailand (BOT) has gradually adjusted the policy interest rate (Policy Rate) since July 2022 from the level of 0.50% and has continued to increase it. In September 2023, the policy interest rate is at the level of 2.50%, however, Thailand has not There has been a high level of inflation, with BOT predicting that Thai inflation will be at 1.6% and 2.6% in 2023 and 2024.

Table 1 : Policy interest and interest on various types of loans.

Source: Bank of Thailand

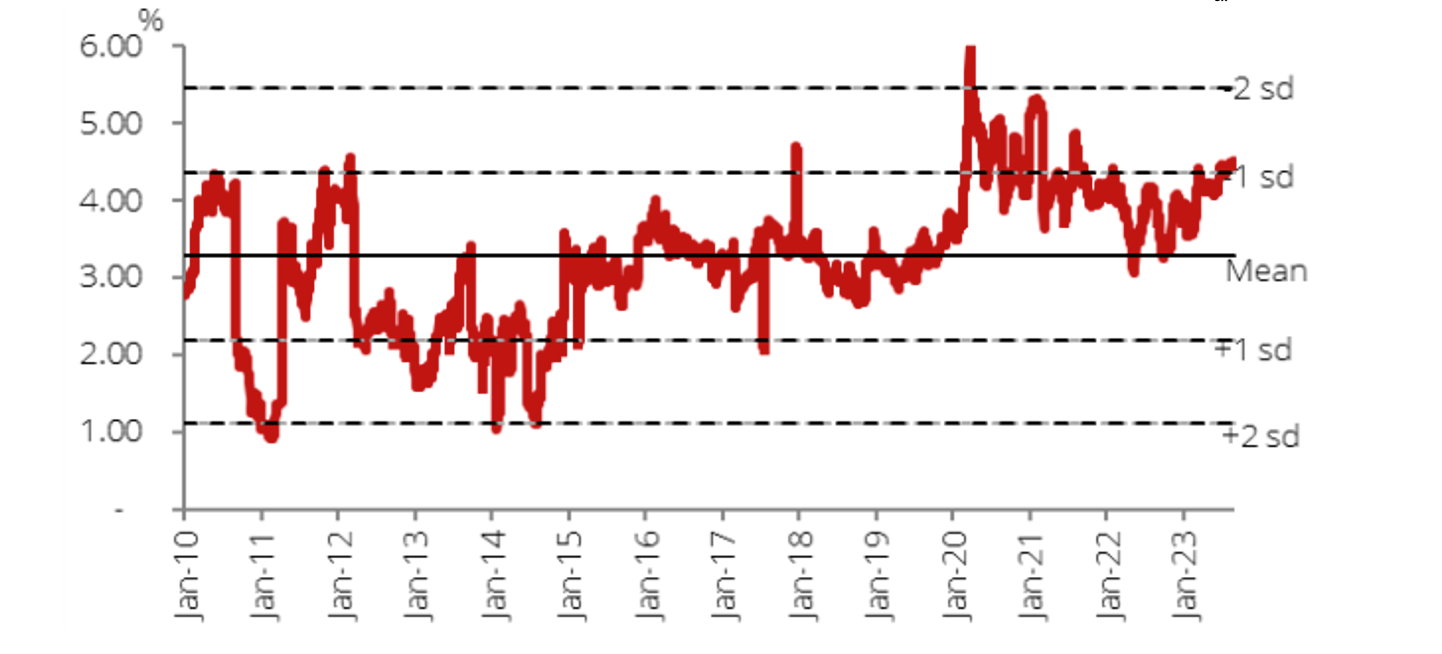

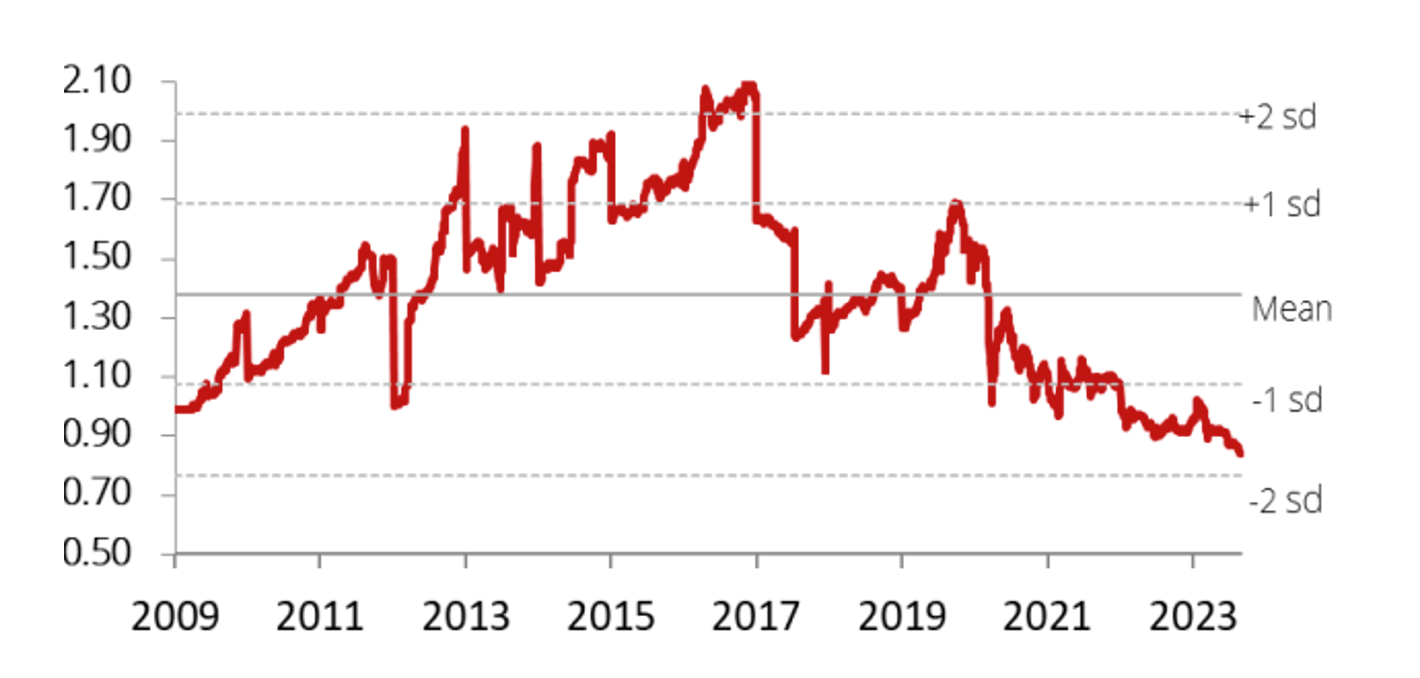

From the above factors and situations, US policy interest rates are likely to be near their highest point. Meanwhile, Thailand's policy interest rates are probably at their highest point. from the expected low inflation rate This causes the trend to increase the Policy Rate again, not so high for mutual funds and real estate trusts. (“Real estate funds”) which are investments that focus on dividend returns will receive more attention. Because investors often consider comparing deposits with interest versus dividends. Moreover, if interest rates are reduced in the future It will increase the interest in investing in real estate funds. At present, the difference between the dividends of real estate funds The 10-year interest rate (Yield Spread) is at a level of 4.2% compared to the historical average of 3.3%. Table 2: The difference (Spread) between the returns (Yield) of real estate funds. with interest on 10-year government bonds

Table 2: The difference (Spread) between the returns (Yield) of real estate funds with interest on 10-year government bonds

Source: Bloomberg, DBSVTH

From above, Yield Spread is still at a higher level than in the past. It reflects various factors such as

1. Performance of the Real Estate Division That is still not the same as in the past, with properties such as offices having an increased vacancy rate and retail space still generating less rental income than before. Especially projects that rely on foreign traffic.

2. Market trading prices of real estate funds is at a lower level than in the past Currently trading at a level lower than book value (Net Asset Value: NAV), currently trading at price/NAV at 0.84 times, compared to the past at 1.41 times.

3. Although interest rates on 10-year government bonds are currently higher than during the same period of COVID-19, But the higher impact from factors 1 and 2 makes the overall spread still higher than the historical average. (Interest on 10-year government bonds at the end of the third quarter of 2023 and 2019 is 3.18% and 1.49%, respectively)

Table 3 : Proportion of market price to book value (P/NAV) of real estate funds.

Source: Bloomberg, DBSVTH

If considering only the top 5 real estate funds with the highest Market Capitalization and high liquidity. which the market price may not reflect the appropriate price It was found that the Real Estate Division There is a ratio of market price to book price (P/BV) or P/NAV at 0.75 - 1.12 times, which indicates that most are still trading at market prices lower than 1 time, which is partly due to the impact of the direction of interest factors that occur. From the central bank's monetary policy to the market price and yield spread of real estate funds.

Table 4 : Market price and P/BV of the top 5 real estate funds with the highest market capitalization.

Source: SET

THE BANGKOK RESIDENCE

"Real Estate for Happiness"

Contact us now

Call Center : 1319

Line @bkkresidence